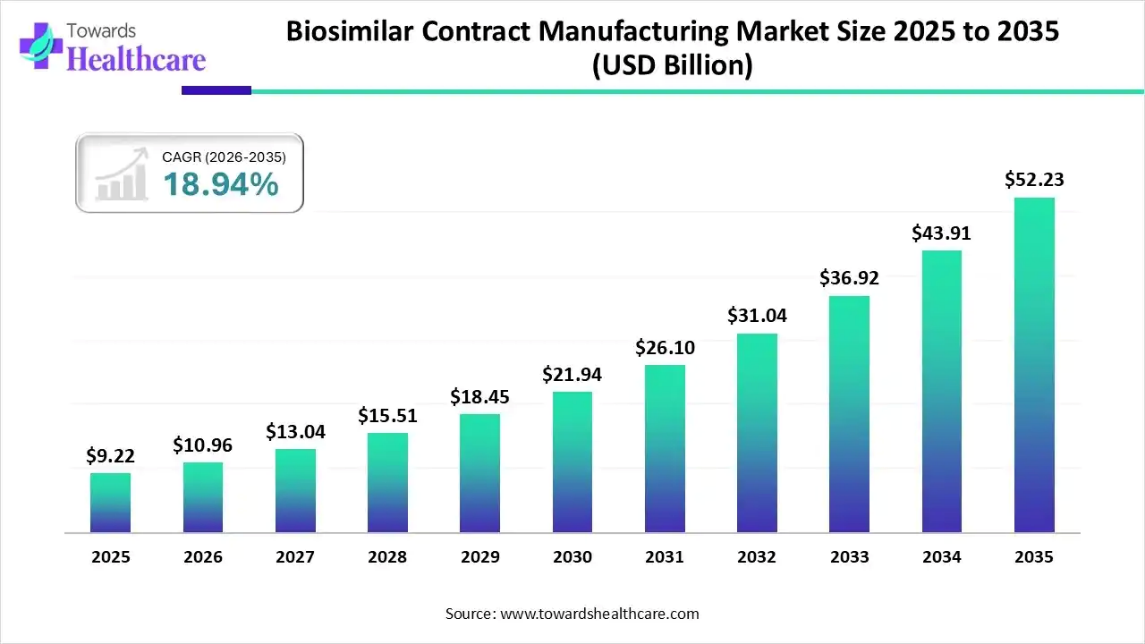

Inside the USD 52.23B Transformation of Biosimilar Contract Manufacturing by 2035

The global biosimilar contract manufacturing market size was valued at USD 9.22 billion in 2025 and is predicted to hit around USD 52.23 billion by 2035, rising at a 18.94% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 17, 2026 (GLOBE NEWSWIRE) -- The global biosimilar contract manufacturing market size is calculated at USD 10.96 billion in 2026 and is expected to reach around USD 52.23 billion by 2035, growing at a CAGR of 18.94% for the forecasted period.

Get a free sample customized to match your exact requirements | Download Now @ https://www.towardshealthcare.com/download-sample/6486

Key Takeaways

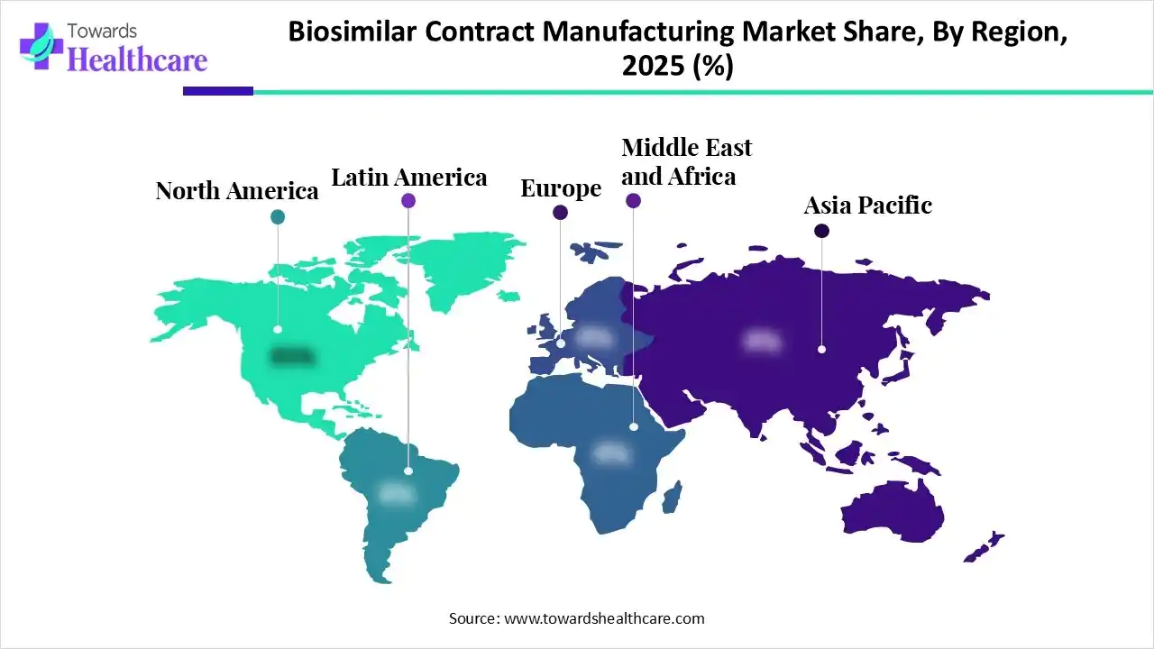

- North America accounted for the largest share of the biosimilar contract manufacturing market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By source, the mammalian segment registered dominance in the market in 2025.

- By source, the non-mammalian segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By services, the recombinant non-glycosylated protein segment led the market in 2025.

- By services, the recombinant glycosylated protein segment is expected to grow at the highest CAGR in the market during the forecast period.

- By therapeutic area, the rheumatoid arthritis segment accounted for a considerable revenue share in the biosimilar contract manufacturing market in 2025.

- By therapeutic area, the oncology segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Biosimilar Contract Manufacturing?

Biosimilars contract manufacturing refers to outsourcing the development, production, and packaging of biosimilar biologic drugs to specialized third-party manufacturers that meet regulatory and quality standards. The biosimilar contract manufacturing market is growing due to rising demand for cost-effective biologic alternatives and increasing patient expirations of major biologic drugs. Pharmaceutical companies are outsourcing manufacturing to reduce capital investment, speed up commercialization, and access specialized expertise. Growing regulatory acceptance of biosimilars, expanding pipelines, and the need for scalable, compliant production facilities are further accelerating market growth worldwide.

For Instance,

-

In April 2025, Chime Biologics entered a strategic partnership with Polpharma Biologics to accelerate global biosimilar development. The collaboration offers integrated support from IND stages through commercial-scale manufacturing, intending to progress toward FDA BLA submission while strengthening the companies’ footprint in the European biosimilars market.

What are the Key Drivers in the Biosimilar Contract Manufacturing Market?

Key Drivers of the market include the rising number of biologic patent expirations and the growing demand for affordable biologic therapies. Pharmaceutical companies increasingly rely on contract manufacturers to reduce development costs, manage complex production processes, and scale efficiently. Supportive regulatory pathways, expanding biosimilar pipelines, limited in-house manufacturing capacity, and the need for advanced analytical and quality-compliant facilities are further driving market growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Ongoing Trends in the Biosimilar Contract Manufacturing Market?

- In July 2025, Celltrion, Inc. revealed plans to invest about 700 billion won (around USD 503 million) to acquire a biologics manufacturing facility in the United States. This strategic move allows the company to localize production of most of its core biosimilar products, strengthening supply security and enhancing its presence in the U.S. market.

- In July 2025, Sandoz announced the development of a new USD 440 million biosimilar manufacturing facility near Ljubljana, reinforcing its long-term commitment to Slovenia. The company plans to scale its total investment in the country to USD 1.1 billion, with the new facility expected to become operational by 2028.

What is the Emerging Challenge in the Biosimilar Contract Manufacturing Market?

An emerging challenge in the market is managing complex regulatory and quality requirements across multiple regions while scaling production cost-effectively. Biosimilars demand advanced process control, analytical validation, and consistency with reference biologics, increasing operational complexity. Limited availability of specialized manufacturing capability, rising compliance costs, technology transfer risks, and pricing pressure from sponsors further strain contract manufacturers, potentially impacting timelines and profitability.

Regional Analysis

What Made North America Dominant in the Biosimilar Contract Manufacturing Market in 2025?

North America dominated the market in 2025 due to its strong biopharmaceutical infrastructure, advanced manufacturing capabilities, and early adoption of biosimilars. The region benefits from a high concentration of biosimilars. The region benefits from a high concentration of experienced CDMO’s Favorable regulatory pathways under the FDA, and increasing investments in biologics capacity expansion. Additionally, rising demands for cost-effective biologics, strong R&D activity, and collaboration between biotech firms and contract manufacturing reinforced North America’s market leadership.

In the U.S., biosimilar contract manufacturing is expanding as pharmaceutical developers increasingly outsource complex biologics production to specialized CMOs equipped with advanced analytics, scalable facilities, and regulatory compliance expertise. Rising biosimilar approvals, patent expiries, and emphasis on affordable therapeutics drive outsourcing demand.

How did the Asia Pacific Expand At the Fastest Pace in the Market in 2025?

Asia Pacific expanded at the fastest pace in the biosimilar contract manufacturing market in 202 due to rapid growth in biologics demand, cost-efficient manufacturing advantages, and expanding biopharmaceutical capabilities. Countries such as China, South Korea, and India increased investments in large-scale biologics facilities and skilled talent. Supportive government with global pharmaceutical companies further accelerated regional market expansion.

In China, biosimilar contract manufacturing is rapidly growing with expanding bioprocessing capacity, supportive government policies, evolving regulatory pathways, and cost advantages attracting both domestic and global partners. Increasing biosimilar pipelines and strategic CMO collaborations boost manufacturing capabilities and appeal to biosimilar developers.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By Source Analysis

How did the Mammalian Segment Dominate the Biosimilar Contract Manufacturing Market in 2025?

The mammalian segment dominated the market in 2025 due to its ability to produce complex biologics with accurate protein folding, glycosylation, and high similarity. Proteins are manufactured using mammalian cell lines, making them the preferred choice for biosimilars. Strong regulatory acceptance, proven scalability, and consistent product quality further reinforced the dominance of mammalian-based manufacturing systems.

The non-mammalian segment is expected to grow at the fastest CAGR during the forecast period due to its cost efficiency, shorter production timelines, and simpler upstream processes. Expression systems such as microbial and yeast platforms are increasingly used for less complex biologics, including peptides and certain proteins. Advancements in genetic engineering improved yield optimization, and the rising demand for affordable biosimilars is accelerating the adoption of non-mammalian manufacturing systems.

By Services Analysis

Why the Recombinant Non-glycosylated protein Segment Dominated the Biosimilar Contract Manufacturing Market?

The recombinant non-glycosylated protein segment led the market in 2025 due to its relatively simpler structure, lower production costs, and high manufacturing success rates. These proteins can be efficiently produced using microbial expression systems, enabling faster scale-up and reduced development timelines. Strong demand for biosimilars of hormones, enzymes, and growth factors, along with established regulatory pathways, further supported the segment’s market leadership.

The recombinant glycosylated protein segment is expected to grow at the fastest CAGR during the forecast period due to rising demand for complex biosimilars, particularly monoclonal antibodies and advanced biologics. These proteins require precise glycosylation patterns best achieved through mammalian expression systems. Expanding oncology and autoimmune pipelines, increasing biologic patent expiration, and greater outsourcing to specialized CDMOs with advanced cell-culture and analytical capabilities are driving rapid segment growth.

By Therapeutic Area Analysis

How did the Rheumatoid Arthritis Segment Dominate the Biosimilar Contract Manufacturing Market in 2025?

The rheumatoid arthritis segment dominated the market in 2025 due to the high global disease burden and widespread use of biologic therapies such as monoclonal antibodies. Multiple blockbuster biologics used in rheumatoid arthritis faced patent expirations, driving strong biosimilar development and manufacturing demand. Consistent long-term treatment needs, favorable regulatory pathways, and strong uptake of cost-effective alternatives further reinforced the segment’s dominance.

The oncology segment is expected to grow at the fastest CAGR during the forecast period due to the rising global cancer burden and increasing use of biologic therapies in cancer treatment. Many high-value oncology biologics are approaching patent expiry, accelerating biosimilar development. Growing demand for affordable cancer treatments, expanding oncology pipelines, and increased outsourcing of complex monoclonal antibody manufacturing to specialized CDMOs are further driving rapid segment growth.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Key Players List

- Boehringer Ingelheim GmbH

- Lonza

- Catalent, Inc.

- Rentschler Biopharma SE

- AGC Biologics

- ProBioGen

- FUJIFILM Diosynth Biotechnologies

- Toyobo Co. Ltd.

- Samsung Biologics

- Thermo Fisher Scientific, Inc.

- Binex Co., Ltd.

- WuXi Biologics

- AbbVie, Inc.

- ADMA Biologics, Inc.

- Cambrex Corporation

- Pfizer Inc.

- Siegfried Holding AG

Browse More Insights of Towards Healthcare:

The global biosimilar monoclonal antibodies market size was estimated at USD 16.05 billion in 2025 and is predicted to increase from USD 19.78 billion in 2026 to approximately USD 129.61 billion by 2035, expanding at a CAGR of 23.23% from 2026 to 2035.

The global biosimilar market size is estimated to grow from USD 40.87 billion in 2025 at 17.6% CAGR (2026 to 2035) to reach an estimated USD 206.75 billion by 2035, as a result of the rising prevalence of cancer, and cost effectivity of biosimilars.

The global human insulin market size was estimated at USD 20.34 billion in 2025 and is predicted to increase from USD 20.97 billion in 2026 to approximately USD 27.68 billion by 2035, expanding at a CAGR of 3.13% from 2026 to 2035.

The global aflibercept biosimilars market size stood at US$ 1.54 billion in 2024, grew to US$ 1.68 billion in 2025, and is forecast to reach US$ 3.7 billion by 2034, expanding at a CAGR of 9.14% from 2025 to 2034.

The global generic sterile injectable market was estimated at US$ 42.42 billion in 2023 and is projected to grow to US$ 119.82 billion by 2034, rising at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2034.

The global oncology biosimilars market size is calculated at US$ 6.7 billion in 2024, grew to US$ 7.94 billion in 2025, and is projected to reach around US$ 36.23 billion by 2034. The market is expanding at a CAGR of 18.47% between 2025 and 2034.

The global biosimulation market size is calculated at USD 3.97 billion in 2024, grew to USD 4.64 billion in 2025, and is projected to reach around USD 18.97 billion by 2034. The market is expanding at a CAGR of 16.94% between 2024 and 2034. Technological advancements, increasing investments in R&D, and growing demand for personalized medicines drive the market.

The global biologics contract research organization market size is calculated at USD 31.15 billion in 2024, will grow to USD 35.22 billion in 2025, and is projected to reach around USD 106.28 billion by 2034, reflecting a CAGR of 13.04%.

The global biopharmaceutical contract manufacturing market size is calculated at US$ 40.14 billion in 2024, grew to US$ 44.61 billion in 2025, and is projected to reach around US$ 115.65 billion by 2034. The market is projected to expand at a CAGR of 11.14% between 2025 and 2034.

The global IVD contract manufacturing market size is calculated at US$ 21.13 in 2024, grew to US$ 23.34 billion in 2025, and is projected to reach around US$ 56.9 billion by 2034. The market is expanding at a CAGR of 10.44% between 2025 and 2034.

Segments Covered in the Report

By Source

- Mammalian

- Non-mammalian

By Service

- Recombinant Non-glycosylated Proteins

- Recombinant Glycosylated Proteins

By Therapeutic Area

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Chronic & Autoimmune Disorders

- Rheumatoid Arthritis

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Invest in this market supported by in-depth forecasts and trends | Buy Now @ https://www.towardshealthcare.com/checkout/6486

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Also Read:

https://www.towardshealthcare.com/insights/oral-solid-dosage-contract-manufacturing-market-sizing

https://www.towardshealthcare.com/insights/contract-gmp-manufacturing-market-sizing

https://www.towardshealthcare.com/insights/proteomics-market-sizing

https://www.towardshealthcare.com/insights/metabolomics-market-sizing

https://www.towardshealthcare.com/insights/microrna-sponge-service-market-sizing

https://www.towardshealthcare.com/insights/lentiviral-vector-market-sizing

https://www.towardshealthcare.com/insights/phosphoramidite-market-sizing

https://www.towardshealthcare.com/insights/ai-in-genomics-market

https://www.towardshealthcare.com/insights/biostimulants-market-sizing

https://www.towardshealthcare.com/insights/cell-line-development-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.