Software-as-a-Service (SaaS) Market Size, Cloud Adoption Trends, and Forecast 2026–2034

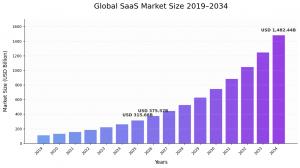

Software-as-a-Service (SaaS) Market Size to Reach USD 1,482.44 Billion by 2034 from USD 375.57 Billion in 2026

North America dominated the global market with a share of 46.9% in 2025”

NY, UNITED STATES, February 10, 2026 /EINPresswire.com/ -- The global Software-as-a-Service market demonstrated substantial value at USD 315.68 billion during 2025. Market projections indicate expansion to USD 375.57 billion in 2026, with forecasts suggesting the sector will achieve USD 1,482.44 billion by 2034. This represents a compound annual growth rate of 18.7% throughout the forecast timeframe. Regional analysis reveals North America commanding a dominant position with 46.9% market share in 2025.— Fortune Business Insights

Request a Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/software-as-a-service-saas-market-102222

Technology Integration and Market Transformation

Generative AI is transforming the landscape by offering automation, personalized user experiences, and enhanced operational efficiency. AI automates various tasks in SaaS platforms, reducing manual effort required for certain processes while enhancing operational efficiency and lowering costs. Platforms leverage AI to create personalized content automatically, with tools helping generate marketing copy, blog posts, and product descriptions. Development tools integrate AI to assist programmers by generating code suggestions, significantly reducing development time and increasing productivity. Industry data indicates AI automated up to 30 percent of all coding tasks in 2023.

Generative AI enables businesses to offer highly personalized experiences, from customized dashboards and product recommendations to tailored customer support. Research shows 70 percent of customers expect companies to deliver personalized interactions, while 69 percent willingly share personal information in exchange for more personalized experiences. Analysts predict that by 2026, 75 percent of SaaS companies will implement AI-driven automation for at least one major business process.

Key Market Drivers and Trends

The micro-SaaS trend gains significant momentum, with approximately 41 percent of SaaS startups in 2023 focusing on niche markets as core business strategy, up from only 18 percent five years earlier. Micro-SaaS provides specialized tools tailored to targeted customer bases, offering faster development cycles, lower overhead costs, and greater flexibility. Acquisition activity increased by 16 percent in 2022, with many focused on small-scale SaaS products. These businesses leverage automation platforms to streamline repetitive tasks, achieving average profit margins of 70 to 80 percent driven by low operational costs.

Rising adoption of multi-cloud and hybrid cloud strategies drives market growth as businesses seek greater flexibility, reliability, and cost-effectiveness. Enterprises avoid vendor lock-in by spreading workloads across multiple cloud providers. Hybrid cloud adoption allows businesses to leverage both on-premise infrastructure and public cloud services, with service providers integrating platforms to support hybrid environments.

Market Segmentation Analysis

Hybrid deployment models project the highest compound annual growth rate during the forecast period, driven by increasing adoption among government agencies, public sector organizations, and banking institutions. Cloud policies worldwide are evolving in response to growing demand for cloud services, with many governments replacing previous policies to meet increased demand for flexibility, visibility, speed, advanced security, and control. Survey data from January 2022 shows 86 percent of U.S.-based respondents planned to increase investment in hybrid cloud and multi-cloud. Public deployment dominated the market in 2024 at 66 percent, with most banking sector companies already shifted to public cloud.

The content and collaboration segment dominated the market in 2025, estimated to record the highest CAGR of 29.19 percent during the forecast period, showcasing 28 percent of revenue share. Business intelligence and analytics tools offer customizable dashboards and reporting features tailored to specific business needs, helping organizations establish and track key performance indicators while ensuring transparency.

Small and medium-sized enterprises anticipate significant CAGR of 21.90 percent during the forecast period. The on-demand software delivery model has transformed the IT landscape, widely adopted by SMEs due to cost-effectiveness, ready availability, and scalability. Large enterprises hold 60.40 percent of market shares in 2026, using SaaS applications to enhance operational efficiency, reduce costs, and increase agility.

Healthcare segment sustains 22 percent of revenue shares in 2025, predicted to record the highest CAGR of 26.00 percent during the projected period. Healthcare professionals migrate applications and storage to cloud to enable hybrid and remote working. Cloud services help medical professionals gain real-time health data insights and minimize IT system complexities. IT and telecom dominated the market in 2024, with 84 percent of IT executives believing SaaS solutions offer more robust security than on-premises alternatives.

Regional Market Performance

North America held the majority market share due to presence of key players and early adoption of technologies including AI, IoT, robotics, and cloud. The United States has approximately 17,000 SaaS companies, valuating USD 141.06 billion in 2026. Research reveals 70 percent of U.S. businesses adopted at least one SaaS solution for enterprise operations, with over 50 percent running mission-critical applications on SaaS platforms. The region witnessed massive shifts in IT infrastructure, with 90 percent of organizations adopting some form of cloud solution. There were over 60 SaaS unicorns in the U.S. in 2023.

Asia Pacific's market size valuating USD 86.06 billion in 2026 projects exponential CAGR of 22.00 percent, driven by demand for increased resilience and agility. Developed and developing economies including China, Japan, and India made significant contributions facilitating regional adoption of cloud-driven technologies.

Europe anticipates gaining prominent market share of USD 70.81 billion in 2026, with 65 percent of European enterprises using SaaS solutions for core functions. Data shows 63 percent of European SMEs use at least one cloud-based application, with 43 percent using SaaS solutions for business operations.

Click for an Enquiry: https://www.fortunebusinessinsights.com/enquiry/book-a-call/software-as-a-service-saas-market-102222

Competitive Landscape and Strategic Developments

Leading companies offer solutions across all businesses, creating new solutions, updating tools and technologies, and expanding scope to enhance technological capabilities. Key players focus on increasing market share and customer reach through strategic acquisitions. Recent developments include Workiva announcing data integration between over 100 cloud, on-premise, and SaaS applications. Salesforce launched Government Cloud Premium offering for national security organizations. Palo Alto Networks acquired IBM's QRadar SaaS assets, enhancing strategic alliance.

Read More Research Reports:

Cloud Computing Market Size, Share & Industry Analysis

Internet of Things (IoT) Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.