Organs-on-Chips Market to Reach USD 1,993.10 Million by 2034 at 27.58% CAGR (2026–2034)

Global organs-on-chips market valued at USD 210.43 million in 2025 is projected to reach USD 1,993.10 million by 2034, growing at a CAGR of 27.58%.

The organs-on-chips market is set to grow from USD 210.43 million in 2025 to USD 1,993.10 million by 2034 at a 27.58% CAGR, driven by predictive preclinical models and precision medicine demand.”

PUNE, MAHARASHTRA, INDIA, February 4, 2026 /EINPresswire.com/ -- The global organs-on-chips market size was valued at USD 210.43 million in 2025 and is projected to grow from USD 283.95 million in 2026 to USD 1,993.10 million by 2034, exhibiting a CAGR of 27.58% during the forecast period. North America dominated the market with a share of 43.80% in 2025.— Fortune Business Insights

Organ-on-a-chip technology refers to microengineered devices containing living human cells arranged within microfluidic channels to replicate the physiological functioning of human organs. These platforms simulate tissue interfaces, fluid flow, and mechanical forces, allowing researchers to mimic real organ behavior in vitro.

Organs-on-chips are widely used in drug discovery, toxicity testing, and disease modeling, offering more accurate, cost-effective, and ethical alternatives to animal testing. Growing demand for human-relevant predictive models in pharmaceutical research is accelerating adoption. Key market participants include Emulate, MIMETAS, InSphero, and CN Bio, all of whom are expanding their global presence to capture larger market share.

Get Free Sample PDF Here: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/organs-on-chips-market-114512

Market Dynamics

Market Drivers

Increasing Demand for Predictive Preclinical Models to Propel Market Growth

Biotechnology and pharmaceutical companies are increasingly adopting organ-on-chip systems due to their ability to generate human-relevant and highly predictive data compared to traditional animal models and 2D cell cultures. These platforms improve toxicity and drug efficacy predictions while reducing R&D costs and clinical failure rates.

Organ-on-chip technology enables early identification of ineffective or unsafe compounds, optimizing the drug development pipeline. Acceptance of Emulate’s Liver-Chip S1 into the FDA’s ISTAND pilot program highlights the growing regulatory interest in these technologies.

Market Restraints

High Development and Implementation Costs to Hamper Market Expansion

The development and deployment of organ-on-chip systems involve high costs due to the integration of microfluidics, sensors, and human-derived cells. Specialized infrastructure, technical expertise, and the absence of standardized protocols increase barriers for small biotech firms and academic laboratories, limiting large-scale adoption and commercialization.

Market Opportunities

Expansion into Personalized Medicine Applications

Organ-on-chip platforms offer strong potential in personalized medicine by enabling patient-specific disease modeling using cells derived from individual patients. These systems allow researchers to evaluate personalized drug responses and bridge the gap between genomic data and clinical outcomes.

The growing adoption of induced pluripotent stem cells (iPSCs) further enhances this opportunity, enabling the creation of patient-relevant organ models for precision healthcare research.

Organs-on-Chips Market Trends

Integration of AI with Multi-Organ Systems

The integration of artificial intelligence with multi-organ-on-chip systems is a key trend shaping the market. AI algorithms analyze large experimental datasets to predict pharmacokinetics, disease progression, and systemic drug responses.

Multi-organ configurations such as liver-heart or gut-brain systems enable comprehensive simulation of human physiology, supporting faster and data-driven decision-making in drug development and toxicology.

Market Challenges

Regulatory Validation and Standardization Issues

Lack of standardized validation frameworks remains a key challenge. Regulatory agencies have yet to fully integrate organ-on-chip data into formal drug approval pathways, slowing industry adoption. Inconsistent reproducibility across platforms and laboratories further complicates regulatory acceptance and commercial scalability.

Segmentation Analysis

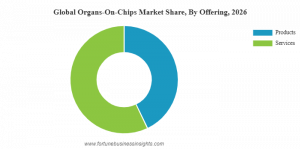

By Offering

The market is segmented into products and services.

The services segment dominated the market with a 57.01% share in 2026, driven by increased outsourcing of drug discovery, toxicity testing, and disease modeling by pharmaceutical companies and research institutions.

The product segment is projected to grow at a CAGR of 30.2% during the forecast period.

By Organ Model

The market includes liver-on-a-chip, lung-on-a-chip, intestine-on-a-chip, kidney-on-a-chip, and others.

The liver-on-a-chip segment led with a 36.64% share in 2026, reflecting its importance in predicting drug metabolism and hepatotoxicity.

The lung-on-a-chip segment is expected to grow at a CAGR of 30.0%.

By Application

The market is segmented into drug discovery & development, toxicology research, disease modeling, and others.

The drug discovery & development segment dominated with a 52.89% share in 2026, supported by expanding service portfolios and demand for efficient R&D workflows.

The disease modeling segment is projected to grow at a CAGR of 30.5%.

By End User

End users include pharmaceutical & biotechnology companies, academic & research institutes, and others.

Pharmaceutical & biotechnology companies dominated the market, accounting for 55.49% share in 2026, driven by widespread adoption for preclinical testing and drug development.

Organs-on-Chips Market Regional Outlook

North America

North America led the market with USD 92.17 million in 2025 and USD 121.85 million in 2026, driven by strong R&D investments and strategic collaborations among pharmaceutical companies and technology providers.

Europe and Asia Pacific

Europe is projected to grow at a CAGR of 28.8%, supported by academic research in the U.K. and Germany. Asia Pacific is emerging as the third-largest region, driven by expanding research infrastructure in China, India, and Japan.

Latin America and Middle East & Africa

These regions are expected to witness moderate growth, supported by increasing research collaborations and gradual adoption of advanced preclinical technologies.

Speak To Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/organs-on-chips-market-114512

List of Key Organs-on-Chips Companies Profiled:

Emulate (U.S.)

MIMETAS B.V. (U.S.)

InSphero (Switzerland)

CN Bio Innovations Ltd. (U.K.)

TissUse GmbH (Germany)

BICO (Sweden)

AIM Biotech (Singapore)

AlveoliX AG (Switzerland)

BiomimX S.r.l. (Italy)

Key Industry Developments

October 2025: CN Bio launched PhysioMimix Core, an integrated multi-organ-on-chip system.

September 2025: Royal Veterinary College partnered with Emulate to expand organ-on-chip applications.

February 2025: Xellar Biosystems partnered with Sanofi for vascular toxicity OOC models.

January 2025: PhenoVista Biosciences partnered with NETRI to enhance scalable assay services.

September 2024: Emulate launched the Chip-R1 Rigid Chip for improved ADME and toxicology studies.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.