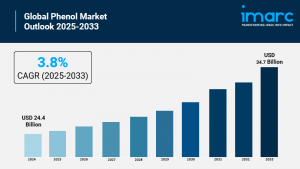

Global Phenol Market Size to Reach USD 34.7 Billion by 2033

Global Phenol Market is driven by the growing demand for various cleaning and sanitizing products, increasing utilization as bio-preservatives.

BROOKLYN, NY, UNITED STATES, January 27, 2026 /EINPresswire.com/ -- The global phenol market was valued at USD 24.4 Billion in 2024 and is projected to reach USD 34.7 Billion by 2033, growing at a CAGR of 3.8% during the forecast period of 2025-2033. Rising industrialization drives phenol demand. Construction activities expand globally. Automotive sector consumption increases. Personal care product usage grows. Cleaning and sanitizing product demand rises. These factors drive the global phenol market. In 2023, Asia Pacific led in the market. Major reasons were the region's strong chemical manufacturing base, robust industrial infrastructure, high production capacity, and proximity to raw material sources for phenol production.Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Period: 2025-2033

Phenol Market Key Takeaways

• Current Market Size: USD 24.4 Billion in 2024

• CAGR: 3.8%

• Forecast Period: 2025-2033

• Asia Pacific dominates the market driven by industrial expansion and chemical manufacturing capacity.

• Bisphenol A leads end-use segment due to widespread application in epoxy resins and polycarbonates.

• Phenolic resins hold significant share in applications segment driven by electronics and automotive demand.

• Cumene process dominates production method offering high efficiency and cost-effectiveness.

• Construction represents major consumption sector with growing infrastructure development.

Request for a Free Sample Report: https://www.imarcgroup.com/phenol-technical-material-market-report-3/requestsample

Market Growth Factors

The worldwide phenol market is expected to grow due to increased industrial usage in numerous industries, owing to its versatility, low cost, and important chemical and physical properties in industrial processes. Phenol is also an important feedstock for the production of bisphenol A, phenolic resins, and caprolactam. A global rise in construction output has led to a large increase in demand for phenol based products. Infrastructure projects in the world's major developing economies have risen by 15-20% in recent years. Additionally, government spending on infrastructure, urban development, and housing construction will likely ensure a steady phenol demand in manufacturing adhesives, foams, and composite wood products for residential and commercial buildings.

Further growth in the market can be attributed to the increasing demand from the automotive industry. Phenol-derived products are used in several automotive applications. Phenolic resins are used in the manufacture of brake linings, clutch facings, interior automotive parts, and molded parts for heat resistance, dimensional stability, and mechanical strength. Rapidly growing vehicle production in developing nations, as well as rising production of electric vehicles, which require more advanced materials, should cause global phenol demand to rise. This demand is being met by the growing availability of new, more efficient phenolic products including bio-based phenols and specialty derivatives.

Increased health awareness and hygiene practices drive the growth of the cleaning products market. Phenol is the main ingredient in disinfectants and antiseptics, and it is also required as a cleaning agent in hospitals. The demand for sanitization is increasing post-pandemic. The global disinfectants market is growing, with phenol-based disinfectants holding a meaningful share, as consumers desire effective products and services to clean surfaces. The rising use of phenolic disinfectants for surface disinfection in hospitals, schools and industrial premises is the key driving factor for market growth. Increasing spending on hospitals and rising hygiene awareness in food processing and pharmaceutical industries are other growth factors.

Market Segmentation

Analysis by End-Use:

• Bisphenol A: Dominates the market due to extensive application in manufacturing polycarbonates and epoxy resins. Polycarbonates used in automotive parts, electronic components, optical media, and construction materials. Epoxy resins serve as critical materials for coatings, adhesives, and composite materials. Strong demand from electronics and automotive industries drives bisphenol A segment growth.

• Phenolic Resins: Growing segment serving construction, automotive, and electronics industries. Provides excellent heat resistance, mechanical strength, and electrical insulation properties. Used in molded products, laminates, coatings, and adhesives for diverse industrial applications.

• Caprolactam: Important segment for nylon 6 production used in textile fibers, engineering plastics, and industrial applications. Automotive and textile industries drive demand for caprolactam-derived materials.

• Alkyl Phenyls: Used as intermediates for detergents, lubricating oil additives, and specialty chemicals. Industrial and commercial applications support steady segment growth.

• Others: Include aniline, cyclohexanone, and various specialty phenolic derivatives serving pharmaceutical, agricultural, and chemical industries.

Analysis by Application:

• Bisphenol A Production: Represents leading application segment driven by extensive use in polycarbonate plastics and epoxy resins. Polycarbonates offer transparency, impact resistance, and heat stability for electronics, automotive, and construction. Epoxy resins provide superior adhesion, chemical resistance, and mechanical properties for coatings and composites.

• Phenolic Resin Manufacturing: Significant application utilizing phenol for producing thermosetting plastics. Used in plywood adhesives, molding compounds, insulation materials, and friction materials requiring heat resistance and dimensional stability.

• Chemical Intermediates: Phenol serves as starting material for synthesizing various chemicals including alkylphenols, chlorophenols, and nitrophenols used in specialty applications.

• Pharmaceuticals & Personal Care: Applied in manufacturing antiseptics, oral analgesics, preservatives, and active pharmaceutical ingredients. Personal care products utilize phenolic compounds for antimicrobial and preservative properties.

• Others: Include agricultural chemicals, dyes, antioxidants, and industrial solvents leveraging phenol's chemical reactivity and functional properties.

Analysis by Production Method:

• Cumene Process: Exhibits clear dominance offering high efficiency and cost-effectiveness for phenol production. Process simultaneously produces phenol and acetone from cumene, providing economic advantages. Majority of global phenol manufactured through cumene oxidation process. Technology maturity and favorable economics ensure continued dominance.

• Toluene Process: Alternative production method gaining attention for specific applications and regional considerations. Produces phenol through toluene oxidation offering different economic profile depending on feedstock availability.

• Others: Include legacy processes and emerging technologies for phenol synthesis from various feedstocks and through different chemical pathways.

Analysis by Grade:

• Industrial Grade: Accounts for majority of market share serving bulk applications in chemical manufacturing, resin production, and industrial processes. Optimized for cost-effectiveness and consistent quality in large-scale operations.

• Pharmaceutical Grade: Premium segment meeting stringent purity standards for pharmaceutical and healthcare applications. Requires higher purification levels and quality control for medicinal and personal care uses.

• Reagent Grade: Specialized segment for laboratory and research applications requiring high purity and precise specifications.

Analysis by Distribution Channel:

• Direct Sales: Represents primary distribution channel for industrial customers requiring bulk quantities. Manufacturers supply directly to large consumers including chemical companies, resin producers, and industrial facilities. Enables customized logistics, technical support, and long-term supply agreements.

• Distributors: Serve medium-sized industrial users and regional markets providing inventory management, local presence, and technical assistance.

• Online Platforms: Emerging channel for smaller quantities and specialty grades serving research institutions, small manufacturers, and specialty applications.

Analysis by Region:

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

Countries Covered: United States, Canada, China, Japan, India, South Korea, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico, Saudi Arabia, UAE

Regional Insights

The Asia Pacific region has the highest phenol market share with wide-ranging industrial development and infrastructure. Increased demand from the construction and automotive industries is also driving the market. Countries like China, Japan, South Korea, Taiwan, and Thailand dominate phenol production. Concentration of production leads to local supply chains, and proximity to major consuming industries opens low-cost distribution and new applications. Asia Pacific is the largest market for chemicals globally, with meaningful investments in petrochemical complexes and downstream chemical products. Increasing construction and urbanization will drive the phenol market in adhesives, resins, and construction applications. The rapidly expanding automotive industry in China and India drives a steady demand for phenol-based components.

Recent Developments & News

In November 2024, INEOS Phenol announced that it would be upgrading processes at its European plants to improve capacity to produce phenol while making production more efficient and environmentally friendly. Shell Chemicals has improved the yield and energy efficiency at its phenol plant in Q4 2024 by upgrading its technology. In September 2024, Mitsui Chemicals partnered with a technology company to produce bio-based phenol from renewable feedstocks. In June 2024, CEPSA Quimica expanded phenol production capacity at its facility in Spain in response to rising demand for phenol in Europe. In March 2024, Formosa Chemicals invested in phenolic resin production technology for electronic applications. In January 2024, Kumho P&B Chemicals launched new grades of high-performance phenolic resin for automotive and electronic applications.

Key Players

INEOS Phenol Gmbh

CEPSA Química S.A. (Compañía Española de Petróleos S.A.U.)

Mitsui Chemicals Inc.

Formosa Chemicals & Fibre Corporation

Kumho P & B Chemicals Inc. (Kumho Petrochemical Co. Ltd.)

Shell Chemicals (Shell plc)

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Our Expert & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=581&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group, 134 N 4th St.

Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

Read Our Latest Insights on:

3D Printing Market Trends, Challenges, and Opportunities: https://www.imarcgroup.com/insight/3d-printing-impact-global-manufacturing-industry

Frozen Food Market Trends, Challenges, and Opportunities: https://www.imarcgroup.com/insight/frozen-food-market-global-trends-challenges-opportunities

Webcams Market Trends, Challenges, and Opportunities: https://www.imarcgroup.com/insight/webcams-market-trends-opportunities

Self-checkout Systems Market Trends, Challenges, and Opportunities: https://www.imarcgroup.com/insight/self-checkout-system-market-reshaping-modern-infrastructure

Tobacco Market Trends, Challenges, and Opportunities: https://www.imarcgroup.com/insight/tobacco-market-modern-infrastructure

Elena Anderson

IMARC Services Private Limited

+1 201-971-6302

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.