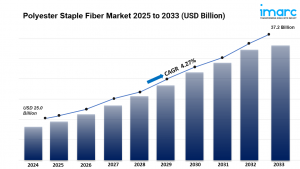

Polyester Staple Fiber Market is Projected to Grow USD 37.18 Billion by 2033 | At CAGR 4.27%

The global polyester staple fiber market size to reach USD 37.18 Billion by 2033, exhibiting a CAGR of 4.27% during 2025-2033.

NEW YORK, NY, UNITED STATES, January 26, 2026 /EINPresswire.com/ -- 𝗣𝗼𝗹𝘆𝗲𝘀𝘁𝗲𝗿 𝗦𝘁𝗮𝗽𝗹𝗲 𝗙𝗶𝗯𝗲𝗿 𝗠𝗮𝗿𝗸𝗲𝘁 𝗢𝘃𝗲𝗿𝘃𝗶𝗲𝘄:The global polyester staple fiber market was valued at USD 25.03 Billion in 2024 and is projected to reach USD 37.18 Billion by 2033, registering a CAGR of 4.27% during the forecast period 2025-2033. The market is predominantly driven by increasing demand from the textile and apparel industry, alongside growth in non-woven applications such as automotive and construction. Asia-Pacific leads the market with a share over 77.6%, benefitting from expanding textile manufacturing and rising disposable incomes.

The global Polyester Staple Fiber Market Share highlight steady growth driven by rising demand for durable, cost-effective, and versatile synthetic fibers across textiles, automotive, and home furnishing industries. Increasing preference for recycled polyester fibers, supported by sustainability initiatives and circular economy goals, is significantly shaping market dynamics. Technological advancements in fiber processing, improved blending capabilities, and enhanced product performance are further boosting adoption. Additionally, rapid urbanization, expanding apparel production, and growth in the nonwoven industry continue to support market expansion. As manufacturers focus on eco-friendly production and high-performance fiber solutions, the polyester staple fiber market is expected to witness robust opportunities in the coming years.

𝗦𝘁𝘂𝗱𝘆 𝗔𝘀𝘀𝘂𝗺𝗽𝘁𝗶𝗼𝗻 𝗬𝗲𝗮𝗿𝘀

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

𝗣𝗼𝗹𝘆𝗲𝘀𝘁𝗲𝗿 𝗦𝘁𝗮𝗽𝗹𝗲 𝗙𝗶𝗯𝗲𝗿 𝗠𝗮𝗿𝗸𝗲𝘁 𝗞𝗲𝘆 𝗧𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀

• Current Market Size: USD 25.03 Billion in 2024

• CAGR: 4.27% during 2025-2033

• Forecast Period: 2025-2033

• Asia-Pacific accounted for over 77.6% market share in 2024, led by countries such as China, India, and Vietnam.

• Rising textile demand in fast fashion and activewear segments is a crucial market driver.

• Non-woven applications in automotive, construction, and hygiene products fuel market growth.

• Innovation in fiber technology and expansion of industrial applications sustain long-term growth.

• The US market is influenced by trade policy changes, such as the Section 201 safeguard on fine denier PSF.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗮 𝘀𝗮𝗺𝗽𝗹𝗲 𝗣𝗗𝗙 𝗼𝗳 𝘁𝗵𝗶𝘀 𝗿𝗲𝗽𝗼𝗿𝘁: https://www.imarcgroup.com/polyester-staple-fiber-market/requestsample

𝗠𝗮𝗿𝗸𝗲𝘁 𝗚𝗿𝗼𝘄𝘁𝗵 𝗙𝗮𝗰𝘁𝗼𝗿𝘀

The polyester staple fiber (PSF) market experiences significant growth driven by the textile and apparel industry's rising demand. Its affordability, durability, and versatility make PSF a preferred choice, especially in fast-fashion and activewear sectors. Additionally, non-woven applications in automotive, construction, and hygiene products are expanding consumption. Urbanization and increasing disposable incomes in emerging economies further augment the market share of PSF, complemented by its cost and performance advantages over natural fibers.

Technological advancements in recycling and sustainable PSF production align with environmental regulations, promoting eco-friendly alternatives. Despite a global decline in recycled polyester shares to 12.5% due to cost and technology constraints, innovations in fiber blending and the growth of artificial cellulosic fibers contribute positively to polyester staple fiber demand worldwide. The market also benefits from expanding industrial use, including insulation, geotextiles, and automotive applications.

The automobile sector presents a lucrative growth avenue, with PSF usage in manufacturing automotive textiles such as roofs, airbags, trunk liners, and sound insulation materials. Growth in light commercial vehicle production, especially in India where demand is expected to rise from 858.61 thousand units in 2025 to 970.05 thousand units in 2030, underscores this trend. Increasing adoption of recycled PSF is supported by corporate sustainability initiatives and circular economy efforts, while government policies and investments stimulate domestic production and market stability.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻

𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀 𝗯𝘆 𝗢𝗿𝗶𝗴𝗶𝗻:

• Virgin

• Recycled

• Blended

Virgin PSF leads with approximately 42.2% market share in 2024 due to its superior quality, consistent performance, and dominance in high-end textile and industrial applications, supported by established infrastructure and cost efficiencies, particularly in Asia.

𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀 𝗯𝘆 𝗣𝗿𝗼𝗱𝘂𝗰𝘁:

• Solid

• Hollow

Solid PSF dominates with around 64.2% share in 2024, prized for versatility and widespread use in textiles, apparel, and industrial applications. Its uniform properties and ease of processing make it suitable for high-volume manufacturing and blending with natural fibers.

𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀 𝗯𝘆 𝗔𝗽𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻:

• Automotive

• Home Furnishing

• Apparel

• Filtration

• Others

Apparel commands about 45.8% of the market in 2024, driven by fast fashion's reliance on affordable, durable, and versatile clothing materials. The growing demand for blended fabrics and innovations like antimicrobial finishes enhance PSF’s role in the apparel segment.

𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀

Asia-Pacific dominates the polyester staple fiber market with over 77.6% share in 2024, driven by robust textile manufacturing, cost-competitive production, and strong domestic demand from countries including China, India, and Vietnam. The region benefits from expanding apparel industries, export-oriented garment production, growing non-woven applications, and government support. Rapid urbanization and rising disposable incomes further amplify demand, positioning Asia-Pacific as the central hub for PSF production and consumption.

𝗥𝗲𝗰𝗲𝗻𝘁 𝗗𝗲𝘃𝗲𝗹𝗼𝗽𝗺𝗲𝗻𝘁𝘀 & 𝗡𝗲𝘄𝘀

• April 2025: Ganesha Ecosphere invested INR 2 crores in its associate company Ganesha Recycling Chain (GRCPL) through a rights issue to strengthen the PET waste raw material supply chain.

• March 2025: Toray Industries, Inc. adopted the mass balance approach to produce TORAYLON™ acrylic staple fiber, combining biomass and plastic waste characteristics, gaining ISCC PLUS certification.

• February 2025: Barmag announced upcoming sustainable and efficient solutions for the Vietnamese textile industry, featuring Oerlikon Neumag EvoSteam staple fiber process, now bluesign® verified.

• January 2025: SHEIN developed a polyester recycling process with Donghua University to enhance fashion sustainability, enabling repeated recycling without material quality loss, with large-scale production planned for June 2025.

• January 2025: Ambercycle and Benma formed a strategic partnership to improve polyester fiber circularity, advancing Cycora staple fiber production.

𝙆𝙚𝙮 𝙋𝙡𝙖𝙮𝙚𝙧𝙨

• Alpek Polyester

• Bombay Dyeing

• Diyou Fibre (M) Sdn Bhd.

• Huvis Corp.

• Indorama Corporation

• Reliance Industries Limited

• Thai Polyester Co., Ltd

• Toray Industries, Inc.

• Vnpolyfiber

• William Barnet and Son, LLC

• Xin Da Spinning Technology Sdn. Bhd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

𝗔𝘀𝗸 𝗔𝗻 𝗔𝗻𝗮𝗹𝘆𝘀𝘁: https://www.imarcgroup.com/request?type=report&id=3869&flag=C

𝘼𝙗𝙤𝙪𝙩 𝙐𝙨

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Elena Anderson

IMARC Services Private Limited

+1 201-971-6302

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.