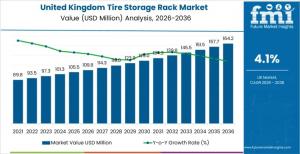

UK Tire Storage Rack Market Outlook 2026–2036: Operational Efficiency Drives 4.1% CAGR Growth

UK tire storage rack sales grow steadily as service centers prioritize safety, space efficiency, and faster vehicle turnaround.

NEWARK, DE, UNITED STATES, January 20, 2026 /EINPresswire.com/ -- The Tire Storage Rack Outlook in the UK shows a structurally stable market expanding in line with automotive service modernization. Sales are projected to reach USD 109.82 million in 2026 and rise to USD 164.22 million by 2036, reflecting a 4.1% CAGR. Growth is no longer tied only to seasonal tire changeovers but to how storage is embedded into daily service workflows.

Tire inventory is increasingly treated as a managed operational asset across dealerships, independent garages, fleet depots, third-party logistics facilities, and multi-location service chains. As service intensity increases, storage racks are being specified as permanent infrastructure rather than temporary warehouse furniture.

Request For Sample Report | Customize Report | purchase Full Report-

https://www.futuremarketinsights.com/reports/sample/rep-gb-31582

Why Storage Infrastructure Is Now a Strategic Decision

For service operators and facility managers, tire rack procurement is shaped by five operational priorities:

- Capacity per footprint to maximize usable floor space

- Safe handling to reduce injury and compliance risk

- Inventory visibility to improve picking speed and accuracy

- Installation flexibility to fit existing layouts

- Long-term durability to support repetitive loading cycles

Structured storage directly improves throughput by keeping service bays clear and workflows predictable. During peak seasonal periods, organized racking prevents congestion, reduces search time, and supports consistent customer turnaround.

UK as a High-Activity Hub for Tire Storage Rack Adoption

The UK hosts a dense network of automotive service locations handling high volumes of passenger car, fleet, and seasonal tires. Many facilities operate in space-constrained or legacy buildings, creating pressure for compact and vertically efficient storage.

Safety and compliance further influence buying decisions. UK Health and Safety Executive guidance emphasizes structured storage, risk prevention, and safe handling. Industry inspection practices reinforce the need for clearly rated, well-maintained racking systems.

Two long-term shifts strengthen demand:

Warehouse modernization, where storage density and access speed are treated as performance metrics

Mechanized handling adoption, encouraging rack designs compatible with trolleys and forklifts

Market Segmentation Reflects Practical Storage Needs

The UK tire storage rack market is highly segmented, reflecting how operators prioritize operational efficiency, safety, and space optimization. Storage solutions are selected not just for capacity, but also for orientation, design, tire type, and material, ensuring that racks support workflow, durability, and ease of access.

Capacity: Compact Racks Dominate

Compact racks with a capacity of up to 10 tires hold a 42% market share, making them the preferred choice in workshops and service bays with limited space.

- Racks with up to 10 tires hold a 42% share

- Favored in workshops and service bays with limited space

- Enable quick access without major layout redesign

Design: Stability Drives Stationary Rack Preference

Stationary racks dominate with a 57% share, reflecting their reliability and long-term durability.

- Stationary racks lead with 57.0% share

- Chosen for predictable durability and inspection routines

- Reduce collision and misalignment risk in high-traffic areas

Tire Type: Passenger Car Tires Lead

Passenger car tires represent 46% of total storage demand, driven by high daily turnover in garages, fast-fit centers, and dealership service departments.

- Passenger car tires account for 46% share

- Driven by high daily turnover across garages and fast-fit centers

- Modular racks support frequent size variation and rotation

Material: Steel Remains the Default Choice

Steel remains the preferred material, capturing a 41% share, due to its strength, durability, and confidence in load-bearing performance.

- Steel holds 41.0% share

- Valued for strength, lifecycle performance, and load confidence

- Preferred for high-frequency handling environments

What Market Dynamics Are Shaping Buying Behavior?

Productivity and Space Economics

Organized racking reduces time spent moving, locating, and stacking tires. Facilities adopting structured storage consistently report smoother workflows and improved bay utilization, directly impacting daily service capacity.

Safety and Replacement Cycles

Racking safety discipline is a major replacement driver. Industry guidance highlights regular inspection, load visibility, and damage monitoring. Standards such as EN 15635 reinforce the need for compliant, easy-to-inspect storage systems.

Opportunities in Modularity and Visibility

Growth opportunities center on:

- Modular racks that scale without disrupting operations

- Systems supporting barcode location labeling

- Designs that protect tires from deformation, heat, and floor contact

Key Threats

Cost pressure delaying upgrades despite safety benefits

Poor installation quality during rapid expansions

These risks push buyers toward suppliers offering clear load ratings, installation guidance, and maintenance support.

Regional Growth Outlook Across the UK

- England (4.5% CAGR): Leads due to dense service networks and high inventory turnover

- Scotland (4.0% CAGR): Driven by durability-focused upgrades and mixed tire handling

- Wales (3.7% CAGR): Growth supported by compact workshops prioritizing safety and organization

- Northern Ireland (3.3% CAGR): Adoption driven by phased, cost-controlled expansions

England also benefits from logistics hubs where tire storage aligns with broader industrial storage efficiency strategies.

Competitive Landscape and Key Participants

Competition focuses on structural reliability, modular scalability, and compliance support. Buyers evaluate suppliers on load clarity, corrosion protection, and ability to support diverse tire types across service and warehousing environments.

Key Industry Participants:

- FEMCO Holdings, LLC

- Steel King Industries, Inc.

- Martins Industries

- Meiser GmbH

- Tier-Rack Corporation

Get data that aligns with your strategic priorities — ask for report customization today:

https://www.futuremarketinsights.com/customization-available/rep-gb-31582

Related Reports

Air Cooled Turbo Generators Market- https://www.futuremarketinsights.com/reports/air-cooled-turbo-generators-market

Plastic Gears Market- https://www.futuremarketinsights.com/reports/plastic-gears-market

Trim Press Market- https://www.futuremarketinsights.com/reports/trim-press-market

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

Why FMI: https://www.futuremarketinsights.com/why-fmi

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.